Surety Bonds Vs. Professional Liability (Errors & Omissions) Insurance

Posted: June 6, 2019

Surety bonds are a useful service, but not the same thing as professional liability insurance, also known as errors and omissions (E&O) insurance. You may need both surety bonds and professional liability insurance to safeguard your business. What Are Surety Bonds? A surety bond is a contract between three or more parties, issued by a surety company on behalf of a party known as the...

Driving Safely In Inclement Weather

Posted: June 4, 2019

The arrival of spring means a long break from icy, snow-packed roads and winter driving conditions. Although snow and ice may not be a problem during the warmer months, inclement weather can still cause hazardous driving conditions. High winds and heavy rains are common in the spring, and peak tornado season is during the spring and summer. Weather Hazards In The Spring and Summer During...

Can I Still See My Own Doctor After Filing For Workers' Compensation?

Posted: May 28, 2019

There is no yes or no answer to that question. Each state has its own set of complicated rules for when you can see your own doctor for a work-related injury covered by workers’ compensation insurance. Generally, but with some exceptions, your employer’s insurance company determines which doctors you see when you have filed a workers’ comp claim. Workers’ compensation can be confusing, and the...

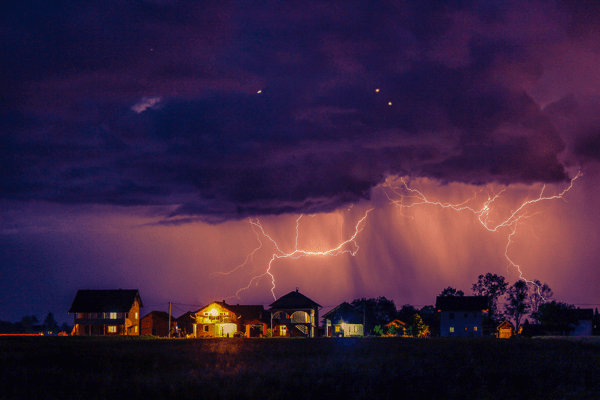

Protecting Your Home During Thunderstorms

Posted: May 27, 2019

Heavy thunderstorms can wreak havoc on a home. The following tips can help protect your property if you live in an area where storms frequently occur. Trim or Remove Trees Storms can snap off tree branches, which can damage your home or detached structures. Get your trees trimmed before the stormy season and cut down any trees that are unwanted. Unless you are confident you...

Do I Need Liquor Liability Insurance If I Only Sell Beer Or Wine?

Posted: May 21, 2019

Despite the name, you will need to make sure you add liquor liability insurance to your business policy if you serve beer or wine at your business. Although most business liability insurance automatically includes host liquor coverage, this only applies to small functions hosted by an enterprise that is not in the business of selling alcohol. Our experienced agency can help ensure you have the...